About

Meet Holly & Judd

Hello! and welcome to our personal finance and family lifestyle blog. Along with our children Kid B and Kid A, we’ve been a family for six years… if you do some pretty basic math you’ve probably deduced that one of us got the bonus of kids included in the relationship. Judd is the lucky dude that got a package deal of three fab ladies.

We met on the internet about seven seconds before the advent of Tinder (back in the day we used OKcupid). Whenever we are overcome with how lucky we are to have each other we say, “how did I ever find you?” to which the other replies, “The Internets!” and then we exclaim, “YAY INTERNETS!”

Within the first literal minute of meeting we discovered our mutual love of Charles & Ray Eames. What was supposed to be a coffee date turned into an afternoon of furniture store browsing all over Minneapolis. We’ve been kind of stuck to each other since. Over the years we’ve curtailed our expensive taste while learning how to remodel and style our home on a serious budget.

Our Financial History

Holly grew up in a trailer park in rural Minnesota– does that say enough? She remembers being sent to the gas station to buy M&Ms with food stamps and that it didn’t seem like a strange or embarrassing thing. She dropped out of high school in her junior year, without protest by her parents, and eventually earned her high school diploma at night school while working overnights in retail.

After having Kids B & A in her early 20’s, Holly relocated to California and then Hawaii, enjoying nearly a decade as a stay at home, homeschooling mom. When she and her ex-husband divorced, she found herself with no work history, no credit history, and took the only job she could find at $9/ hour.

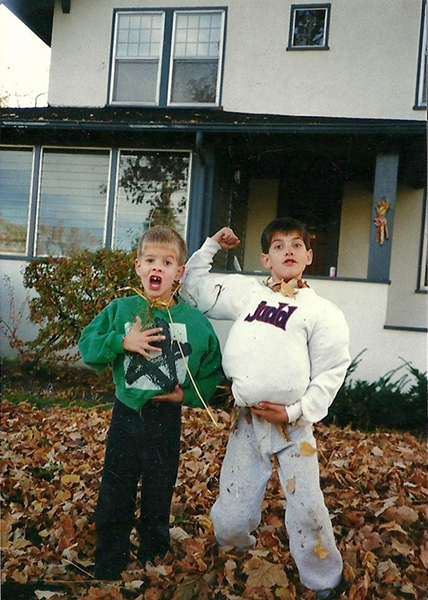

Judd grew up in a middle-class family in St. Paul, Minnesota. His mom was an elementary school teacher and his dad owned a small business. Judd’s financial education began early when his grandfather introduced the Stock Market Game to him in fourth grade (he placed 3rd in state with his Disney and Norwegian Cruise Line picks).

Always a hard worker, Judd mowed lawns and carried golf clubs as a teenager to save for large purchases (yo boombox!). At 19 he started funding his 401(k). Judd bought his first house at 20 while working full time and attending college—and started house hacking before he knew there was a term for it, renting out the extra rooms to his friends to cover the cost of his mortgage.

Finding The FIRE Movement

Coming from two very different financial upbringings, it wasn’t easy to get on the same page with financial planning and retirement until we created a shared vision for our perfect future life.

Believe it or not, our relentless motivation for building this perfect life started with a ketogenic diet (the “diet fad” of 2019 that people won’t shut up about). We began a keto diet in June 2018 as an experiment and were immediate life-long converts. We started sleeping better, having more energy, more mental focus, and felt motivated in a hundred different directions. Keto was the starting off point for us to improve our lives and our health in every possible way. After bio-hacking our diets we wanted to find the life hacks to improve in every other area as well.

When it comes down to it, we just really like each other and want to spend as much time together as possible.

We sat down as a family and watched the Playing with Fire documentary on New Year’s day of 2020. It was like flipping a switch in our our collective brain. The math to early retirement really is shockingly simple. Waking up to the fact that we were exchanging life hours to buy things from stores that would never matter as much as the time we wanted to spend together was a realization we could not let go of.

We started Nolan Nest to share our journey to financial independence and to become a part of this amazing FIRE (Financial Independence / Retire Early) community. We are by no means financial experts but hope you will follow our story and that it will inspire you on your own path to FIRE.